The index has been on the rise over the past 10 years, when rental penetration was just under 40 percent in 2005. Up 100 basis points from 52.9 percent in 2013 to 53.9 percent in 2014, the ARA Rental Penetration Index has been growing steadily since the dramatic dip in the index between 20.

In addition to the steady growth pace, the climbing ARA Rental Penetration Index is another indicator of equipment rental market vitality.

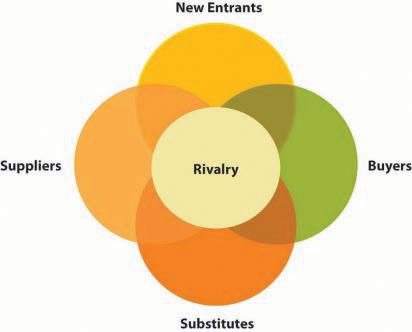

#Threat of new entrants in the equipment rental industry driver

The ongoing rebound in real residential construction will be a primary driver of overall growth in the construction/industrial equipment category in the near future, according to analysis provided by ARA research partner IHS Economics, the leading international forecasting firm that delivers data and analysis for the ARA Rental Market Monitor. While the projected construction/industrial growth pace is slightly more moderate than the previous 2 years, it represents more than double the growth rate of the general U.S. In the construction and industrial segment, an average annual increase of 6.5 percent is anticipated over the next 5 years, including 6.8 percent in 2016 and 6.9 percent in 2017. equipment rental industry revenue growth of 6.7 percent in 20, 6.2 percent in 2018 and 5.8 percent in 2019 to reach $48.7 billion. 15, 2015, the latest analysis from ARA, through its ARA Rental Market Monitor subscription service, calls for overall U.S. The secular shift toward rental is here to stay." Construction Rebound Fuels GrowthĪRA monitors the industry on a quarterly basis to ensure that association members have the best information available in a dynamic economic environment. "Many customers who have turned to renting during and after the recession have seen the benefits and will continue to rent to control and manage their costs. "The industry's positive economic outlook means equipment rental companies can prepare for steady growth, plan for expanding their markets and build inventory to meet customer demand," said Christine Wehrman, ARA CEO and executive vice president. Earlier in 2015, the ARA Rental Penetration Index indicated that construction/industrial rental penetration rose for the fifth straight year to 53.9 percent in 2014, the most recent reporting year. November's industry forecast from ARA projected steady growth in United States equipment rental revenue through 2019, including 6.8 percent construction and industrial growth in 2016. Not only will the industry mark the 60th anniversary of the American Rental Association (ARA) at the annual trade show, but recent economic indicators also point to a healthy and growing industry. When the equipment rental industry converges on Atlanta this month for The Rental Show 2016, the mood will be celebratory and optimistic.

0 kommentar(er)

0 kommentar(er)